Usual cash advances and flexibility- these two things do not go together. But who has the time to think about these when there is a cash emergency? Yes, that is exactly why lending predators have been charging you high interest rates while offering you repayment terms from just one to four weeks. Some direct flex loan lenders started giving a little flexibility -maximum term up to two paycheck days, but they charged you more- like rollover fees. If you had bad credit, then maybe you got very little cash. The list of issues with such payday advances is really long. Now, enough of those.

Experience the real flexibility with CapitalPaydayLoan's online flex loans with no credit checks that offer terms up to 3 months! With any kind of credit background, now you can get quick flex loans online on the same day by filling out an application form that takes only 3 minutes!

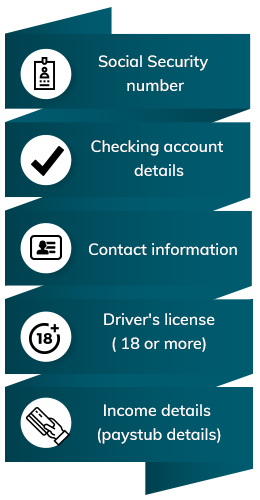

Flex loans for bad credit are not a frequently heard thing, but we, as a frontline credit company, do things that others don't. We ensure our customers -irrespective of their credit status- get to secure their finances. Our guaranteed approval flex pay loans readily give them cash up to $1,000 in their checking account after they earn instant approval on successful application. Apart from no credit checks and longer repayment terms, our flex pay financing offers a fully automatic and secure process that keeps your personal details confidential, low interest rates that are borrower-friendly, free application round-the-clock and no hidden fees whatsoever. Even your low income is sufficient to apply for a loan with monthly payments!

Customers find great value in our online flex loans. As online flex loans direct lenders, we offer loans with ultimate flexibility - choice in repayment pattern and tenure, choice of using our online flex loans to improve credit scores, no early payment penalties, and the option to convert payday loans into installment loans are some examples of value-added features of our loans.

There are many store-based lenders of flex loans available around you. Flex loans online, however, are the easier solution, and since our service remains available round-the-clock, it is easy to see why it's more valuable to most end-users. Apart from this, there are other reasons that people today prefer these online flex loans, such as:

With these key benefits and more, there's much that an online lender can offer that could be more challenging for the pawn-store based lender to match. Hence, today's borrowers prefer borrowing their flex loans online.

Our flex pay loans give you urgent cash quickly and the much required flexibility and affordability while availing and repaying the loan. Feeling a financial crisis mount upon you? Apply for a flex loans bad credit from direct lenders online now!

Lending with maximum flexibility and reliability that makes borrowing easy and customizable

Flex loans for bad credit with instant approval are designed to be accessible, even for those with poor credit scores. You can quickly secure the funds you need, avoiding the stress and lengthy processes associated with traditional loans. Flex loans provide the flexibility to borrow what you need, when you need it, without being penalized for your credit history. Flex loans for bad credit with instant approval are a great option for those looking for quick cash without the hassle. Plus, you don't have to worry about a high interest rate or strict repayment terms.

At CapitalPaydayLoan, we specialize in helping you navigate financial challenges with ease. Our goal is to provide you with fast, reliable, and accessible lending solutions, regardless of your credit history. We understand that life can be unpredictable, and that's why we're committed to offering flexible loans that can help you overcome unexpected expenses. With us, you can count on a straightforward application process and the support you need to get back on track.

This service and website is an invitation to send us a Payday loan application, not an offer to make a loan. We are registered with Utah's Department of Financial Institution. If we approve your loan application, the funds will be disbursed from our account in Utah. Utah law governing consumer loan agreements may differ from the laws of the state where you reside. This service may or may not be available in your particular state.